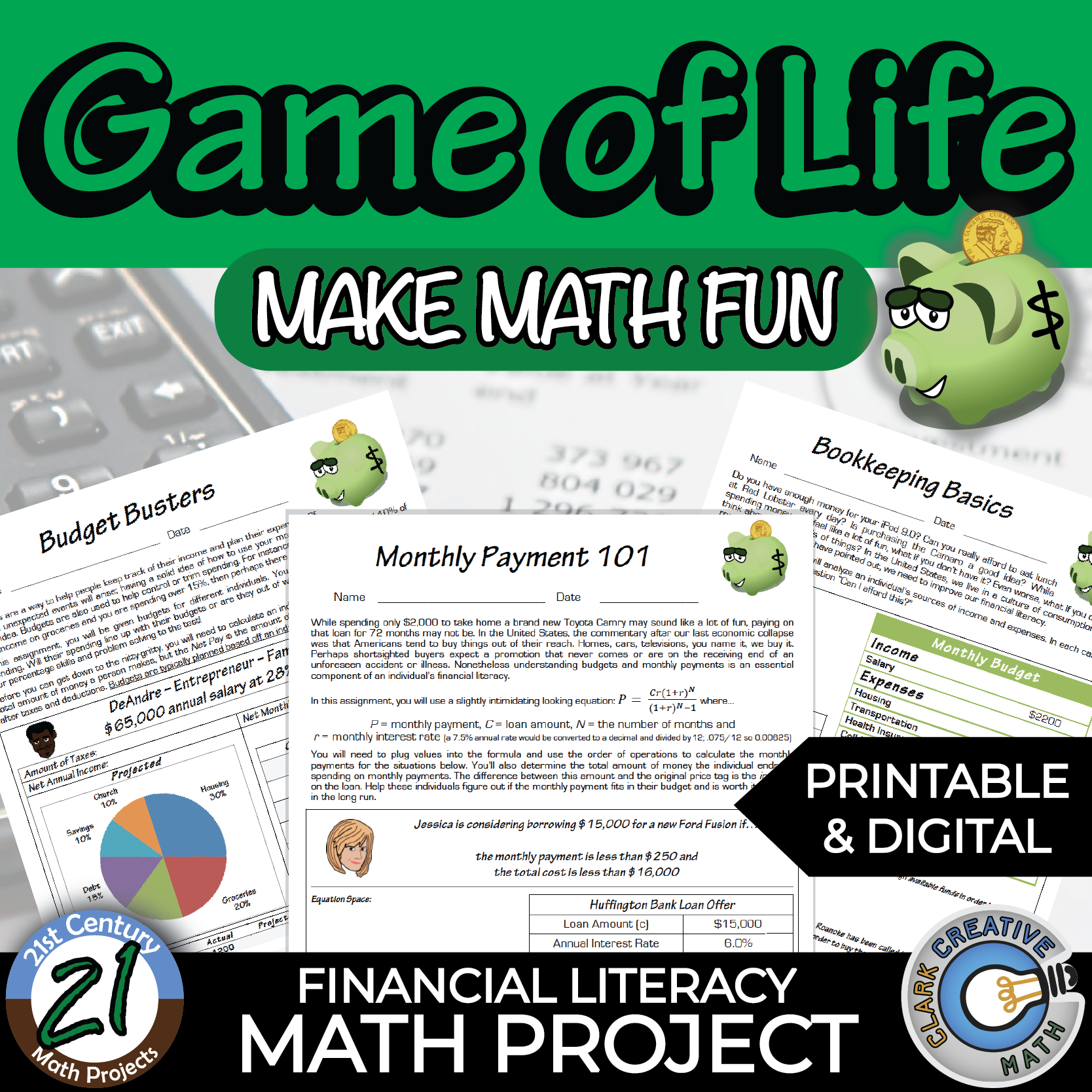

The Game of Life: A Financial Literacy Real-World Math Project

A Real-World Financial Literacy Project That Makes Math Feel Practical

A game of life financial literacy project helps students see why math matters. Instead of isolated practice, students simulate adult life: careers, paychecks, taxes, budgets, bills, and real financial choices.

The Game of Life is a financial literacy real-world math project where students calculate net pay, manage expenses, respond to “life events,” and make decisions that impact their financial future.

Suggested Grade Level: 6–12 (middle school through high school)

Best for: Percent Applications, Budgeting, Taxes, Personal Finance, Word Problems

How This Game of Life Financial Literacy Project Works

Students simulate adult life through a structured sequence of decisions. They choose a career, calculate pay, determine taxes and deductions, build a budget, and manage recurring expenses.

Along the way, students respond to unexpected “life events” that require them to adjust their budget, think strategically, and make responsible financial choices.

What Students Do

- Select a career and calculate salary or hourly pay

- Compute taxes, deductions, and net pay

- Create a budget for housing, transportation, food, and other expenses

- Track spending and adjust plans when surprises occur

- Compare outcomes and reflect on decision-making

Skills Students Practice

- Percent applications (taxes, discounts, interest-like calculations)

- Operations with decimals and whole numbers

- Budgeting and financial planning

- Reading, interpreting, and responding to word problems

- Making decisions based on quantitative evidence

Why This Real-World Math Project Works

Students often ask, “When will I ever use this?” This project answers that question in the most direct way possible.

Because the math is tied to real decisions—income, expenses, and consequences—students stay engaged. They also walk away with practical knowledge that can impact them long after your class ends.

When to Use This Project

- During a percent applications or personal finance unit

- As an end-of-unit performance task

- For financial literacy month or life-skills lessons

- As a real-world enrichment project

- Anytime you want students practicing math that genuinely matters

More Real-World Math Projects

Teachers searching for creative math activities often want something that moves beyond worksheets while still reinforcing meaningful learning. Financial simulations are one of the strongest ways to build engagement because students can immediately see the purpose.

If your students enjoy this simulation-based approach, browse our full collection of 21st Century Math Projects where students analyze data, make recommendations, and defend their reasoning with math.

Looking for more real-world math experiences? Browse our full collection of 21st Century Math Projects designed to make students think, collaborate, and apply math like it matters.